Find out now if you are entitled to PIS PASEP, learn how to check with your CPF and also how to request the withdrawal of your benefit.

Being a salaried worker brings many benefits and among them is the PIS PASEP, but not everyone knows how this benefit works and that it is possible to withdraw your PIS PASEP. In other words, it's possible that you have money saved up and don't even know it.

First of all, you need to understand what PIS PASEP is. PIS and PASEP are programmes created in 1970 with the aim of strengthening the relationship between employees and employers, as well as promoting a more equitable distribution of income in Brazil.

The main difference between PIS and PASEP is that the former is aimed at private sector workers, while the latter caters for civil servants. In 1975, both were unified into a single PIS/PASEP Fund, whose resources are directed to the FAT (Workers' Support Fund).

PIS/PASEP registration is compulsory for all workers in their first job with a formal contract. The number generated is unique and valid for life, even if you change jobs. Workers in private companies must inform their employer of their PIS number in order to deposit FGTS, while civil servants use PASEP.

Through the payment of tax contributions by companies and public institutions, workers become entitled to benefits such as the Severance Indemnity Fund (FGTS) and unemployment insurance.

It may be of interest to you:

It's important to note that workers with a formal contract, in both the public and private sectors, are theoretically entitled to the PIS PASEP salary allowance. However, in order to receive the benefit, some specific criteria must be met, which will be described below.

Knowing more about PIS/PASEP means that workers are aware of this important income supplement programme. This initiative seeks to contribute to the financial security and well-being of Brazilian workers, promoting the integration and socio-economic development of the country.

In this article we've put together the main information about the PIS PASEP benefit and how you can check and withdraw your forgotten money!

Quick Index:

What is PIS PASEP?

The PIS (Social Integration Programme) and PASEP (Public Servant Equity Training Programme) were created in 1970 with the aim of strengthening the relationship between employees and employers and promoting better income distribution in Brazil.

They are programmes linked to tax contributions made by private companies and public institutions, which guarantee benefits such as FGTS and unemployment insurance to workers.

It might make sense to you:

- Contactless payment: is it safe?

- Best Credit Cards to Earn Air Miles in Brazil

- The 7 Best Credit Cards in Brazil: A Detailed Analysis

Differences between PIS and PASEP

PIS: Aimed at private sector workers.

PASEP: Aimed at civil servants.

Both were merged in 1975 to form the PIS PASEP Fund, whose resources are directed to the FAT (Workers' Support Fund), which is responsible for funding unemployment insurance and wage subsidies.

Who is entitled

Employed workers, both in the public and private sectors, who meet the following criteria:

- PIS/PASEP registration for at least five years.

- Have worked for a legal entity for at least 30 days in the base year in question.

- Receive an average salary of up to two minimum wages during the base year.

- Data correctly informed by the employer in RAIS or eSocial.

In addition, other categories are also entitled, such as company employees with 5 years of PIS/PASEP registration, pensioners, elderly people over 60, disabled people, reservists from the Military Police and people with malignant neoplasms.

Who is NOT entitled

- Domestic workers.

- Urban and rural workers employed by individuals.

- Workers employed by individuals treated as legal entities.

How to check your PIS PASEP

You can check your PIS or PASEP through the identification number, which can be found on your work permit, FGTS statement, Citizen Card (for PIS) or Banco do Brasil branch (for PASEP). You can also obtain the number via the CNIS website.

To make the enquiry, follow these steps:

- Go to the Federal Government's website and select the "Receive Salary Allowance" service.

- Log in with your gov.br details or register if necessary.

- Select the "Salary Allowance" option and check that the base year is correct.

- If you are entitled, the payment amount and availability date will appear on the screen.

How is PIS PASEP calculated?

The amount of the PIS/PASEP salary allowance is calculated in proportion to the months worked by the professional during the base year.

When calculating, it is important to know that the amount of the allowance will never exceed the minimum wage in force.

Let's use an example to illustrate:

Practical example:

- Base year: 2023

- Minimum wage: R$ 1412,00

If a worker worked for 6 months during the 2023 base year, the amount of the allowance will be calculated as follows:

Amount of the allowance= Number of months worked x Minimum Wage/12

Substituting the values from the example:

Amount of the allowance = 6 x R$ 1.412 / 12

Amount of the allowance = 6 x R$ 117.67

Amount of the allowance = R$ 706.00

Therefore, a worker who worked for 6 months during the 2023 base year will receive an amount of R$ 706.00 as a PIS PASEP salary allowance.

It is important to note that if the worker has worked for all 12 months of the base year, they will receive the maximum amount of the allowance, which is the total amount of one minimum wage in force.

How to withdraw your PIS PASEP

To request the withdrawal of PIS/PASEP quotas, follow these steps:

- Check the balance available for withdrawal in the "My FGTS" application or on the FGTS website.

- In the "My FGTS" application, select the option to request the withdrawal and transfer the balance to your current account, if you prefer.

- If you want to withdraw your money in person, make sure you have an amount of up to R$ 3,000 to withdraw at Caixa branches, self-service terminals, lottery shops or Caixa Aqui correspondents. If the amount exceeds R$ 3,000, the withdrawal must be made at a Caixa branch.

- When making a withdrawal in person, take an official photo ID with you.

Requesting a withdrawal from a deceased worker

To withdraw the PIS of a deceased worker, the legal beneficiary must go to any Caixa Econômica Federal branch, present valid identification, the deceased worker's death certificate and other necessary documents, depending on the situation.

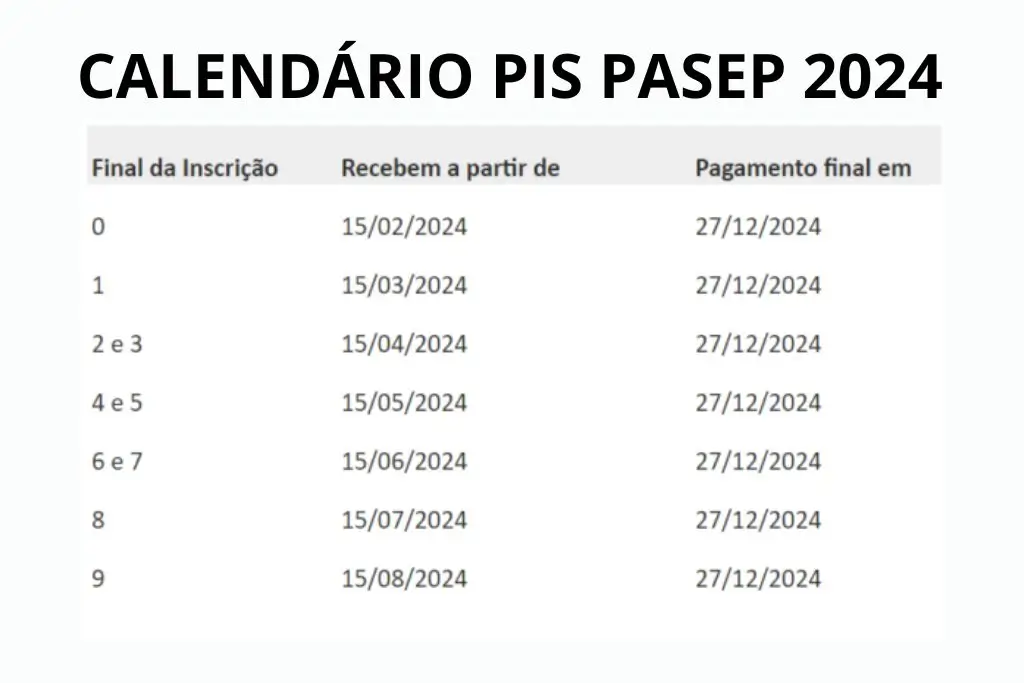

PIS PASEP withdrawal calendar 2024

Conclusion

PIS PASEP offers important benefits to Brazilian workers, supplementing their income and promoting participation in the results of companies and public institutions.

By strengthening the relationship between employees and employers and promoting a fairer distribution of income, these programmes play a fundamental role in the country's socio-economic development, guaranteeing the financial security and well-being of citizens.

Read also: All about Desenrola Brasil